Member Benefits

Breadcrumb

Secure your assets

Bank how you want

Plan for your retirement

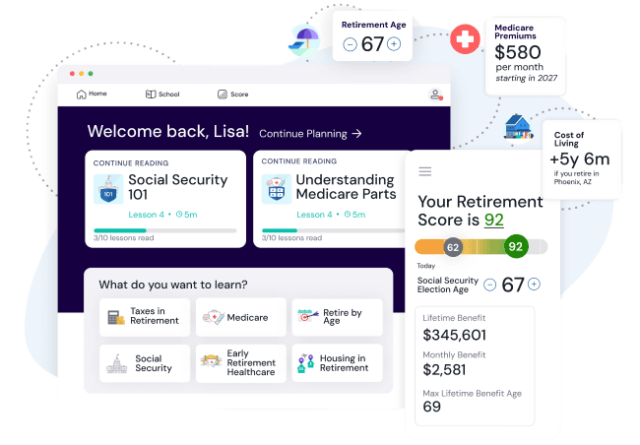

Retirement Simplified

Powered by Silvur

As an OCCU member, you get free access to easy-to-use tools and personalized resources to help you navigate retirement with financial confidence.

Save during tax season

More member benefits

Order checks

Reload your stock of checks.

Notaries

All OCCU branch locations offer free notary services for members with the exception of the following documents:

- Documents presented by a nonmember

- Will(s) or documents associated with a will

- I-9 Form for employment verification

- Documents that require a witness instead of a notary

- Documents that are certified and/or considered public records (e.g. marriage licenses, divorce decrees, birth or death certificates, etc.)

- Document written in a foreign language in which the notary is not fluent

If you have any questions about whether we can notarize your documents, please give us call at 541.687.2347.

Signature guarantees or medallions

These services can only be performed for current members. Call your closest branch to confirm a certified employee is available and you have the appropriate documents ready.

Accidental death and dismemberment insurance

TruStage™ Accidental Death & Dismemberment Insurance is provided at a basic level with additional coverage available at competitive rates.

Regular free financial seminars

Members are invited to regular seminars on first-time home buying, paying for college, protecting yourself from financial crimes and other subjects. Stay tuned by checking the "OCCU calendar" on the homepage of our website.

3 or **Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. OCCU may, but shall not be required to under any circumstances, make these funds available on the day the payment file is received, which may be up to three (3) days earlier than the scheduled payment date. OCCU does not assume any liability for not depositing these funds to your account early. OCCU may terminate early access at any time without notice.