What's a FICO score anyway?

We all have a FICO score, or at least anyone who has ever used credit does. Although you may be familiar with the concept of a credit score, do you really know what goes into coming up with a FICO score?

“FICO scores have a fair amount of mystique and legend about them,” says Ethan Nelson, OCCU’s vice president of lending. “A lot of people can give you their opinion on them, but myfico.com is a good resource for factual information.”

Essentially, a credit score summarizes the risk that a lender takes by lending money to an applicant. The higher the score, the lower the risk should be to the lender. There are several types of credit scoring companies, but FICO, which stands for Fair Isaac Corporation, is the most widely used score. FICO scores have a range of 300-850 points. A higher score will not just qualify you to borrow, but it may help you qualify for lower rates on credit cards, mortgages, and other loans.

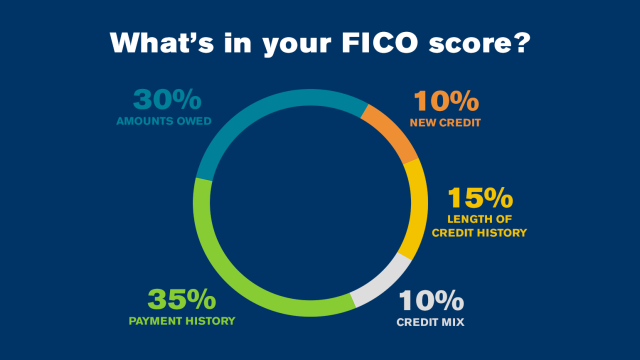

The minimum information that FICO must have to determine your score is at least one account that has been open for six months or longer. Your score is determined by data from five categories: payment history, length of credit, amounts owed, credit mix and new credit.

Payment history

Your score is based 35% on the payment history of your accounts. Your payment history includes accounts like credit cards, retail accounts, installment loans, finance company accounts and mortgages. While making your payments on time will definitely help your score, a late payment will not automatically kill your score.

Credit length

Length of your credit history matters also. Your score is based 15% on whether you’ve been paying your bills on time for years or only for a couple of months.

Current debt

Also taken into consideration with 30% weight, is the amount you owe at the time your credit is checked. To determine the amount you owe, FICO looks at the amount you owe on all accounts, the amount owed on different types of accounts, the percentage of your available credit that you’re using and how many accounts have balances. “Owing money doesn’t necessarily mean you’re a high risk borrower with a low FICO Score,” says myfico.com. “However, when a high percentage of a person's available credit has been used, this can indicate that a person is overextended, and is more likely to make late or missed payments.”

Mix of credit

Your FICO score is based 10% on the mix of your credit accounts. The key is to have credit cards, as well as other loans, and manage them responsibly. People with no credit cards are considered a higher risk than people who have managed their credit responsibly through loans solely backed with collateral, such as an auto loan. It’s important to note that a closed account will still show up on your credit history and be considered in your FICO score.

New credit

The last 10% of your FICO score is influenced by any new credit. For instance, if you suddenly open several new accounts right before having your credit checked, your score may reflect that negatively depending on what type of credit you applied for.

In fact, new credit is the source of one myth about FICO scores: that they drop anytime you have your credit checked to apply for new credit. In truth, says the FICO website, they probably won’t drop much. “If you apply for several new credit cards within a short period of time, multiple requests for your credit report information (inquiries) will appear on your report,” says myfico.com. “Shopping for new credit can equate with higher risk, but most credit scores are not affected by multiple inquiries from auto or mortgage lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on the credit score.”

What is NOT in your score

None of the following items are reflected in your score: race, color, religion, national original, sex and marital status. Neither is your age, salary, occupation, employment history, where you live, any interest rate charged on a particular credit card, any items reported as child/family support obligations, any request that you have made to check your own credit, or whether or not you’re participating in a credit counseling of any kind.

Improving your FICO score

It’s important to remember that your credit history is a snapshot in time. It can and will change from time to time. You can improve your score. It will take time, but it is worth it.

Start by requesting a free copy of your credit report from AnnualCreditReport.com. If you notice errors like incorrectly reported late payments, accounts you haven’t opened or addresses you’ve never lived at, you should dispute these errors immediately.

Next, since making your payments on time is one of the biggest factors determining your scores, set up payment reminders or schedule recurring payments in Bill Pay. Finally, focus on reducing the amount of debt you owe.

Taking the mystery out of the FICO score puts the power in your hands to improve your score. And we’re here to help! Check out more resources on managing your credit.