CU difference in action: Oregon credit unions’ $2.8 billion economic impact

Our Oregon communities are like ecosystems. When members work together and pool their resources to supply each other’s needs, everyone benefits. When organizations work together to shore up the community’s foundations, the effects ripple outward.

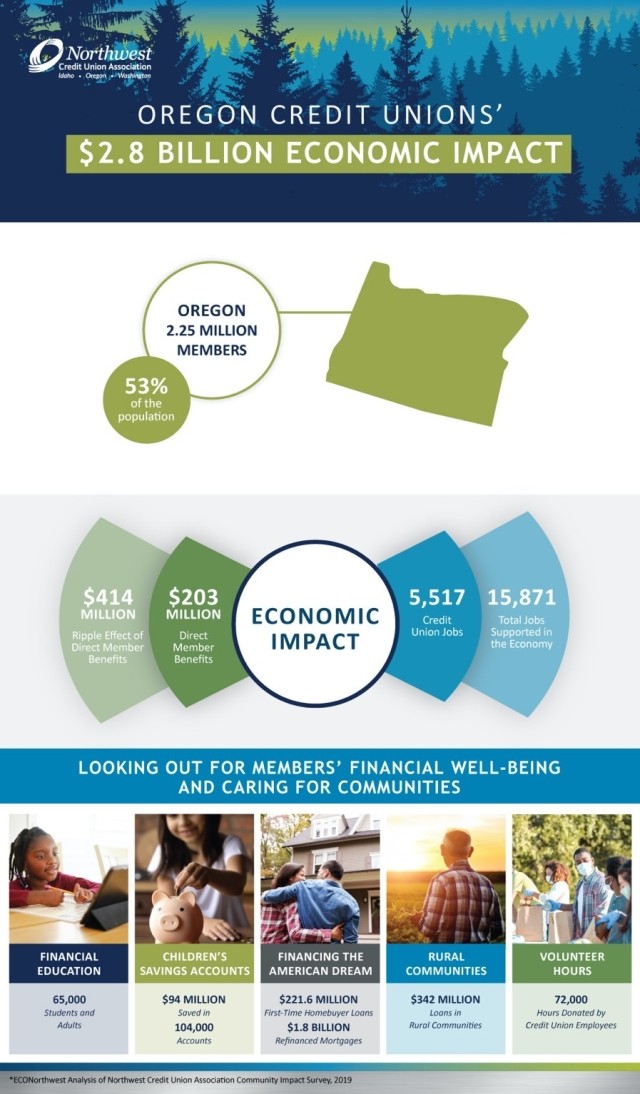

Credit unions are the cornerstone of a healthy, sustainable community. Founded on cooperative principles and a “people helping people” philosophy, credit unions across our state are collaborating to create an economic support network for all our communities. Credit union membership is growing as people increasingly recognize the value of our not-for-profit model; credit unions now serve 2.25 million members statewide, which is more than half the population.

How big a difference do credit unions really make? The Northwest Credit Union Association (NWCUA) created an infographic showing how Oregon credit unions made a $2.8 billion economic impact last year.

“Credit unions were founded with the people helping people mission, and Northwest credit unions are living up to it, day in and day out,” says Jennifer Wagner, NWCUA’s executive vice president and chief advocacy officer.

How credit unions make a difference

If you want to make an impact, you need to start with a crystal-clear vision. At OCCU, our vision is to enrich lives. Other credit unions might say it a bit differently, but we all share a similar commitment to building community resilience and helping our members thrive.

That commitment is what makes us different from other financial service providers. Unlike for-profit businesses, we’re not here to make money. We’re here to invest in you and our communities. We do this by:

Giving back our profits. Whatever profits we make go right back to our members in the form of both direct and indirect member benefits, including great interest rates, minimal fees, and a host of other helpful benefits. Oregon credit union members got back $203 million in direct benefits last year, which caused a ripple effect amounting to an additional $404 million.

Partnering with charitable organizations. When there’s a need in our community, we pitch in and help however we can. Credit union employees across the state donated 72,000 volunteer hours to giving back. At OCCU, our employees contributed 942 volunteer hours. Plus, our OCCU Foundation raised more than $250,000 for our Fire Relief Fund and distributed nearly $550,000 in grants and scholarships.

Building financial wellness. Credit unions don’t just offer financial tools and services—we help build financial wellness. In the past year, credit unions provided financial education to 65,000 students and adults statewide, helping them learn how to use the tools at their fingertips to achieve long-term financial stability and growth.

Providing employment opportunities. When the pandemic forced many industries to shut down and decrease employment, Oregon credit unions hired extra staff, growing our workforce by 1.3% and collectively supporting more than 15,000 jobs within our state’s economy. OCCU opened new branches and continues to hire for a variety of positions. We’re growing to be there for our membership at a time when we need one another.

These are just a few of the ways Oregon credit unions are making a difference. Bottom line: Our cooperative, community-oriented approach works—and it’s having a powerful effect on our state’s economic ecosystem.

Will you join us in helping to make our communities more resilient?